The United States is on the brink of a senior care crisis, a challenge that is becoming increasingly apparent with the aging of the baby boomer generation.

According to Harvard’s Joint Center for Housing Studies, nearly 70% of older adults will require long-term care services at some point, a need that is not sufficiently covered by Medicare and often results in long waitlists for Medicaid’s at-home support.

Today, we’ll go into the details of this crisis, highlighting the realities faced by seniors and exploring potential pathways forward.

What are the harsh truths about caring for seniors?

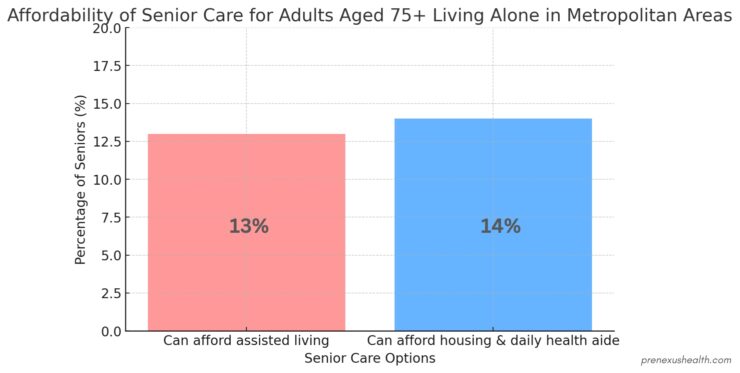

The cost and accessibility of senior care in the U.S. are pressing issues. Notably, only 13% of adults aged 75 and older living alone in metropolitan areas can afford assisted living without dipping into their assets. Even fewer, 14%, can afford the combined costs of housing and a daily visit from a home health aide.

These statistics paint a troubling picture of the financial viability of care for a significant portion of the senior population. Furthermore, the solitude many older adults face exacerbates the situation.

A growing shortage of care workers and facilities

The care industry itself is facing its own set of challenges, notably a pervasive shortage of care workers. Every state in the U.S. reported such shortages this year, with 43 states witnessing the permanent closure of care facilities.

The Demographic Shift

Compounding these issues is the fact that U.S. life expectancy is on the rise, which translates into a growing demand for long-term care services. This demographic shift is occurring alongside a reduction in available family support, as the need for services and support for older adults living at home increases.

The combined effect of these trends points to a looming crisis that demands immediate and sustained attention.

Financial viability and quality of care

For many seniors and their families, the costs associated with housing and daily care are too high, often exceeding their means. This financial burden is not just a matter of numbers; it reflects a deeper crisis in the quality of life and dignity of older people.

As such, the senior care crisis is not only a challenge of logistics and economics but also a profound ethical issue.

What are the potential solutions?

Firstly, there is a critical need to expand and improve Medicare and Medicaid to cover more long-term care services and reduce waitlists.

Secondly, incentives for careers in the caregiving profession could help alleviate the workforce shortage. Investment in technology and innovative care models could improve the efficiency and quality of services provided to seniors.

Last but not least, there must be a societal shift in how we view and value aging and senior care. Community-based solutions, enhanced family support systems, and policies that prioritize the well-being of older adults can contribute to a more sustainable and compassionate care system.

FAQs

Why doesn’t Medicare cover long-term care services?

Medicare is primarily designed to cover short-term medical costs and hospital care, not long-term care services, which are considered custodial care (help with daily activities).

Can long-term care insurance alleviate the burden of care costs?

Yes, long-term care insurance can help cover the cost of care that Medicare does not. However, it’s important to purchase a policy before health issues arise, as premiums can be costly and conditions may disqualify some individuals.

What are some strategies for seniors to manage care costs without relying solely on savings?

Strategies include long-term care insurance, reverse mortgages for financial flexibility, exploring shared housing options, and utilizing community and government programs that offer support and services.

How can communities support seniors who live alone and require assistance?

Communities can support seniors through local volunteer programs, creating senior-friendly spaces that encourage social interaction, and offering transportation services to help seniors access care and maintain independence.

To sum up…

The U.S. stands at a critical juncture in its approach to senior care. With a rapidly aging population and a care system under strain, the time for action is NOW. By addressing the financial, logistical, and societal challenges head-on, we can work towards a future where all seniors receive the care and respect they deserve.

I am a retired internal medicine physician named Dr. William Tousignant. With over three decades of experience in the field of geriatric care, I specialized in diagnosing and managing health issues among senior patients throughout my career.